Europe’s Solar Energy Market in 2025: Challenges and Opportunities

Over the past decade, solar energy has become a cornerstone of Europe’s transition to clean energy. Thanks to ambitious climate targets, widespread public support, and falling costs, solar installations continue to expand across the continent. As we move toward 2025, however, the market faces fresh challenges—from supply chain uncertainties to evolving policy landscapes—that also bring significant opportunities for growth and innovation. Below, we explore the key trends and hurdles likely to shape Europe’s solar energy sector in the near future.

1. Driving Forces Behind Solar Expansion

De Europese Green Deal en nationale CO₂-neutraalplannen stimuleren een versnelde uitbreiding van zonne-energie. Veel lidstaten zetten tot 2025 fors in op nieuwe installaties om hun 2030-doelen te halen. Tegelijkertijd zijn de kosten voor zonnepanelen en PV-technologie in het afgelopen decennium sterk gedaald, waardoor zonne-energie in vrijwel alle EU-landen tot de goedkoopste vormen van energieopwekking behoort. Dit maakt het toegankelijk voor huishoudens, bedrijven én coöperatieve initiatieven.

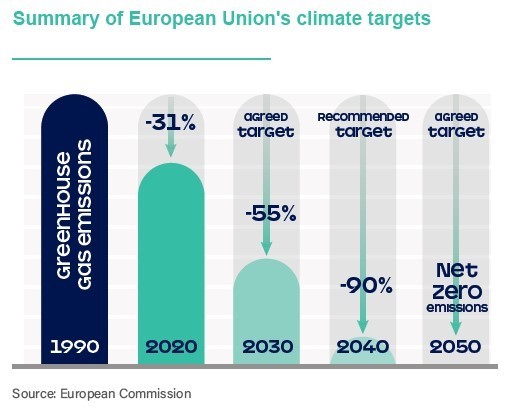

Ambitious Climate Goals

The European Green Deal, along with national pledges to achieve net-zero emissions, has spurred demand for renewables. By 2025, many EU member states will be accelerating their solar capacity expansions to meet intermediate 2030 climate targets. This policy push creates a favourable investment environment, especially for large-scale solar projects.

Cost Competitiveness

Over the last decade, the cost of photovoltaic (PV) panels and associated technology has fallen dramatically. Even with supply-chain fluctuations, solar remains one of the most cost-effective forms of new electricity generation in many European markets. As a result, solar energy is no longer an option only for large utilities or wealthy households—it is becoming increasingly accessible to a wider range of consumers and businesses.

2. Key Challenges in 2025

2.1 Supply Chain Vulnerabilities

Europe’s solar industry heavily depends on imported solar modules and components. Recent geopolitical uncertainties and manufacturing bottlenecks have highlighted the risks of relying on a single region for critical parts. Tariffs, trade disputes, and COVID-related disruptions have made procurement more complex and costly.

Implications:

- Price Volatility: Fluctuating module prices could slow project timelines or raise costs.

- Energy Security Concerns: Reliance on external supply chains may threaten the EU’s strategic autonomy in the energy sector.

2.2 Grid Integration and Storage

As solar penetration grows, managing the variability of renewable power becomes more challenging. Grid operators must handle surges during sunny days and lulls during cloudy conditions. While the technology for energy storage (like batteries, pumped hydro, and green hydrogen) is evolving, large-scale solutions are still in development, and there can be regulatory and cost barriers to their adoption.

Implications:

- Grid Upgrades: Aging grid infrastructure in some EU regions needs modernization to accommodate higher renewable penetration.

- Policy Hurdles: Clear incentives for storage deployment and flexible grid management are essential but still under negotiation in various member states.

2.3 Fragmented Policies

While the EU sets overarching targets and directives, each member state has the autonomy to design its own solar incentive schemes (feed-in tariffs, auctions, tax credits, etc.). This fragmentation can create market unpredictability for solar developers operating across borders.

Implications:

- Complex Compliance: Solar projects must navigate different permitting processes and support mechanisms in each country.

- Uneven Growth: Regions with favourable policy environments may see stronger expansion, while others lag behind.

3. Emerging Opportunities

3.1 Homegrown Manufacturing

To reduce supply chain vulnerability, the EU and individual member states are aiming to revive or scale domestic solar manufacturing. Public-private partnerships, manufacturing incentives, and technology investments could lead to a robust, pan-European solar supply chain.

Benefits:

- Local Jobs: Building panel manufacturing facilities and component supply chains in Europe creates skilled employment opportunities.

- Reduced Carbon Footprint: Shorter transportation routes and stricter environmental standards can lower the carbon intensity of solar products.

3.2 Innovative Business Models

Rooftop and community solar programs are gaining traction. Citizens and small businesses can now form energy cooperatives, invest in shared solar farms, or lease rooftop space for installations. Additionally, new financing models—like pay-as-you-go solar or subscription-based services—are broadening access, especially for individuals previously deterred by high upfront costs.

Benefits:

- Greater Public Participation: Community-based models can increase social acceptance and local engagement in the energy transition.

- Energy Democracy: By involving households in the energy market, power generation becomes more decentralized and less reliant on big utilities.

3.3 Hybrid Solutions and Energy Storage

As technology advances, the integration of solar with other renewable sources (wind, hydro, geothermal) or with storage systems is becoming more viable. Hybrid power plants that combine solar and battery storage, for instance, can offer more stable and reliable power output.

Benefits:

- Grid Stability: Stored energy helps balance supply and demand, reducing strain on the grid.

- Flexibility in Power Markets: Hybrid solutions can participate more effectively in balancing markets, potentially generating additional revenue streams for developers.

3.4 Digitalization and Smart Grids

The transition to smart grids is another key development. Innovations in IoT (Internet of Things), data analytics, and artificial intelligence enable more efficient grid management and predictive maintenance of solar assets. Consumers can also leverage smart meters and energy management systems to optimize consumption—aligning usage with times of high solar generation.

Benefits:

- Reduced Operational Costs: Automated monitoring lowers downtime and improves asset performance.

- Consumer Empowerment: Households can track and manage energy usage more effectively, potentially lowering bills and carbon footprints.

4. Policy and Market Outlook

By 2025, European policymakers will likely prioritize energy security, decarbonization, and economic recovery in a post-pandemic world. Thus, solar energy will remain at the forefront of policy discussions. We can expect:

- Stricter Emission Caps: Stronger carbon pricing or emissions trading could drive further investment in renewables.

- Harmonization Efforts: The EU may take steps to reduce policy fragmentation, potentially introducing standardized permitting or financial incentives.

- Increased Funding for R&D: Research in breakthrough solar technologies (e.g., perovskite cells, tandem panels) and storage solutions will be a strategic focus.

5. Conclusion

Europe’s solar energy market in 2025 stands at a pivotal juncture. On one hand, challenges like supply chain disruptions, grid integration complexities, and fragmented policies present significant hurdles. On the other, opportunities abound in domestic manufacturing, innovative financing, and the convergence of solar with digital solutions and storage technologies.

For governments, industry stakeholders, and consumers alike, success will hinge on collaboration, forward-thinking regulations, and sustained investment in research and infrastructure. If Europe can address its supply chain vulnerabilities, streamline policies, and capitalize on emerging technologies, the continent is well-positioned to remain a global leader in solar energy—propelling the region closer to its ambitious climate and sustainability targets.

Large stock of systems & materials

Large stock of systems & materials